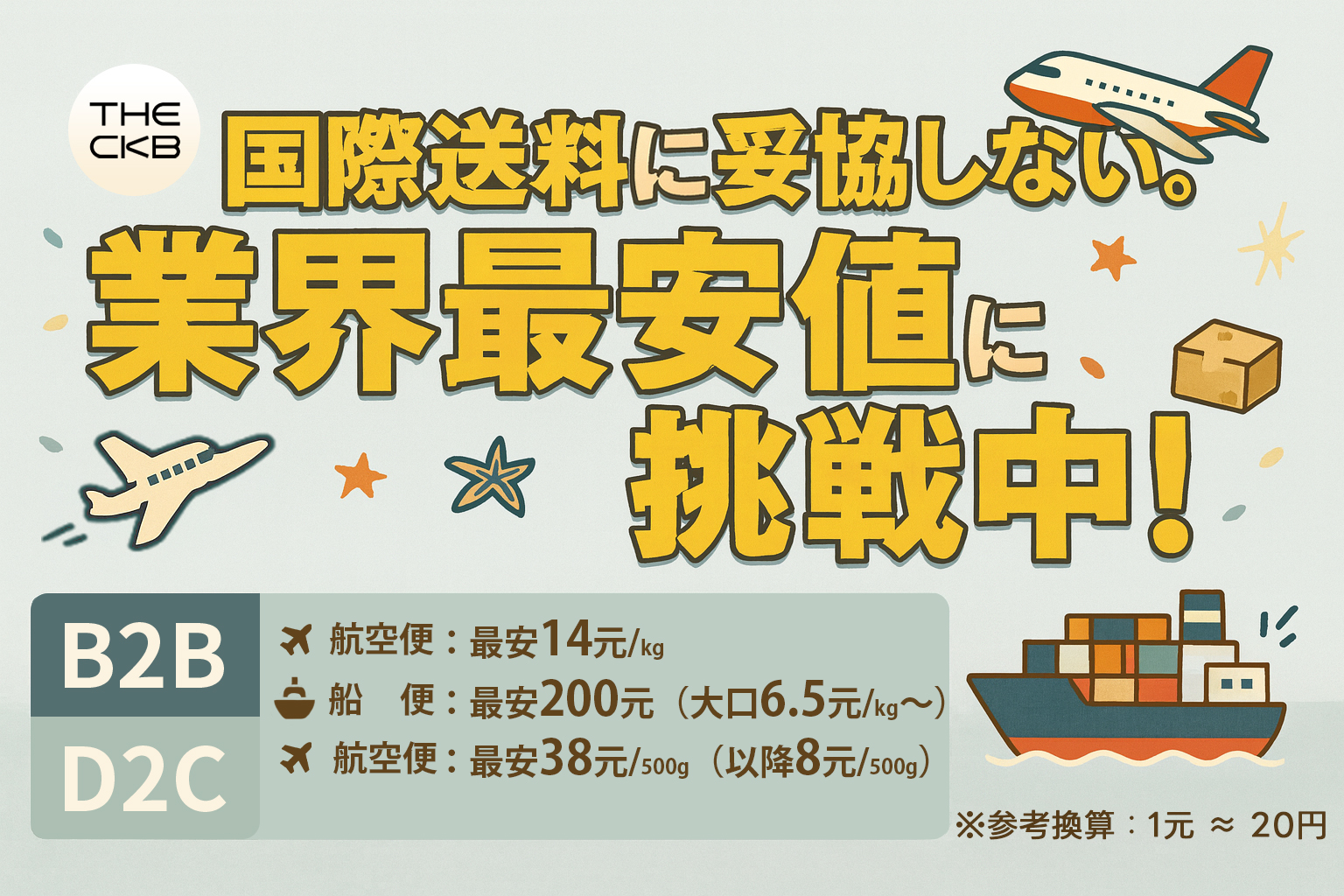

コストに妥協しない。最安水準の国際送料、ここに。

\ 他社より高ければ、ぜひ教えてください! /

小口直送も大口発送も、国際送料は業界最安水準。

航空便最安 38元(約700円)~

船便最安200元(約40,000円)~

無料登録ですぐに送料をシミュレーション。

自社商品のコストを事前に把握できるから、初めての海外仕入れでも安心です。

▶ 詳しくはこちら > https://www.theckb.com/price/shipping-fee/

Things people starting a side business in importing China for the first time should knowThe fact that "expenses are allowed" and knowledge of "what expenses are allowed".

Because if you don't know this when filing your income tax return, you will not only pay extra taxes, but it will also affect the amount of your resident tax.

I know that expenses can be recorded somehow, but many people don't really understand what kinds of expenses are recognized as expenses and to what extent.

This time, for those who are new to such a side job, I will explain mainly about the expenses that can be recorded when filing a final tax return.

The content is focused on importing from China, so please understand it well,Get informed about tax savings

目次

Before we talk about expenses, firstTax returns. By understanding it, you can understand the importance of expenses related to side jobs.

A tax return in a nutshell"Procedures for paying income tax".

If you are a company employee, you do not need to go to the tax office to do so because the company already withholds taxes such as income tax from your salary. However, if your annual income from side jobs exceeds 200,000 yen, you will need to file a tax return.

The applicable period is defined by the Income Tax Act as "income generated in a year from January 1 to December 31".

The "income" of 200,000 yen, which is the basis for filing a tax return for a side job, is the income minus the necessary expenses.

For example, even if the annual income is 400,000 yen, the total expenses required for the Chinese import business, such as the cost of purchasing a personal computer for business use, the cost of attending seminars, and the storage warehouse cost, were 250,000 yen. In this case, your income will be 150,000 yen and you will no longer need to file a tax return. If the total expenses are 100,000 yen, your income will be 300,000 yen, and you will be obligated to file a final tax return, but this will lead to tax savings.

If you make a mistake in the necessary expenses at the time of this calculation, you will end up filing a final tax return that is not necessary, and the tax saving effect will fade.

There are 10 types of income: interest income, dividend income, real estate income, business income, salary income, retirement income, forest income, transfer income, and temporary income. , the following three incomes.

Among these three types of income, most of the income obtained from side jobs falls under miscellaneous income, so expenses are recognized.

If the scale of your side business grows, it is possible to turn it into a business income. In that case, the tax return will be "Blue return", There are tax incentives such as special deductions compared to "white return".

If you file a final tax return with a "blue return", you can start a side job with your business income if you submit an "application for approval of the blue return of income tax" to the tax office and receive approval by March 15 of the year. becomes.

However, it will be judged based on the following facts.

In addition, since double-entry bookkeeping, balance sheet, and profit and loss statement are required for blue returns, beginners of side businesses often start with white returns.

However, recently, accounting software has been enhanced, and the work for tax returns has become easier than before, so when the Chinese import business gets on track and the scale grows It would be nice to choose to make it an income. If you can afford the profit, there is also an option to ask a tax accountant.

There is no upper limit to the amount of expenses for a side job. It is possible to include the full amount used to earn income from a side job as expenses.

However, when recording expenses, you need to know what is an expense and what is not. And if you are always conscious of the expenses you can record and get into the habit of keeping receipts related to necessary expenses carefully, you can get a big tax saving effect on your final tax return.

The taxable income for importing into China as a side business is sales minus necessary expenses. The main items that can be recorded as necessary expenses are as follows.

There are many types of necessary expenses for product sales, and among them, imports from China are a business that straddles overseas, so there are expenses that other product sales do not have, such as tariffs, customs clearance fees, and agency fees.

Looking at these items, there are costs that can be counted as costs incurred in side jobs, and costs that are difficult to calculate separately from private costs.

For example, rent and utilities. In the case of a side job, I think that I often work at home, so I'm worried about how to calculate the cost of the side job. In that case, a method that is often used is a method called housework apportionment, which is based on the business ratio. Specifically, it is a method of dividing the area of the room used as a workplace in the home by the total area and dividing the cost proportionally.

Suppose that the total area of your home is 80 square meters, the area of the room you are working in is 20 square meters, and the rent is 150,000 yen. In this case, it is possible to calculate the rent as an expense for the side business as follows.

Rent (150,000 yen) x workshop area (20㎡) ÷ total area (80㎡) = 37,500 yen

The same calculation method can be used for high heating costs and internet connection costs.

In the case of owning a house, the same concept can be used to calculate expenses, but unlike renting, it is calculated by adding "depreciation expenses". If the working area and total area are the same as the previous example, calculate the expenses as follows: Depreciation cost is the depreciation rate according to the useful life determined by the structure of the property.

Home Acquisition Price x Depreciation Rate x Workshop Area (20㎡) ÷ Total Area (80㎡)

Using this calculation method, the following is the result of calculating the amount that can be recorded as necessary expenses when the acquisition price of the home is 30 million yen and the depreciation rate is 4%.

30 million yen x 4% x workshop area (20m2) / total area (80m2) = 300,000 yen

Since the depreciation rate is calculated on an annual basis, the resulting costs will also be recorded on an annual basis.

In this way, when importing from China as a side business, expenses are recognized unlike part-time or part-time jobs.

Items that cannot be expensed aregeneral private costs. If you include the cost by mistake, you will be subject to penalties such as delinquent tax and additional tax, so please avoid recording the following expenses. Typical examples are as follows.

Only business-related expenses can be recorded as side business expenses, and private expenses such as living expenses are not included. Specifically, this includes food and beverage expenses, rent, utility expenses, etc. that are not related to business.

Medical expenses and life insurance premiums cannot be expensed. Some people think that business cannot run without the person, but medical expenses and life insurance premiums are judged to be the subject of the individual.

It depends on the type of final tax return, but in the case of a white return, even if you ask your family to help you with a side job and pay the compensation in the form of a salary, the salary to the family cannot be recorded as an expense. On the other hand, if you have filed a blue return and are using the blue full-time salary, you can include the full amount of your family salary as an expense.

However, when filing a declaration, the following documents are required to prove that there was a business transaction, even if it is a family member.

required Documents: Business contract, quotation, delivery note, invoice

It's a small detail, but if you work in a cafe like the Nomads, the cost of drinks is a necessary expense, but the cost of food can't be expensed. The reason is that you can use the cafe only for drinks.

When it comes time for people who are new to Chinese imports as a side business to file their tax return, they often have trouble with the amount of work and lack of documents to prepare when they start preparing. Therefore, it is important to keep the following points in mind.

The biggest cost for importing business in China is the purchase price. In many cases, we purchase and sell low-priced products in large quantities, so it is important to keep accurate daily records.

If you are using a purchasing agency, there are places where you can download materials related to purchasing, so it is one way to use them.

However, it is important to note that not all purchase amounts can be recorded as expenses when filing a final tax return, and only the purchase amount that leads to sales is treated as an expense.

Once you understand which items can be expensed, you should keep all receipts for those items. Without it, there would be no proof that the expense was spent, and it would not be possible to record it as an expense.

It's a little troublesome, but if you decide where to store it and sort it by month using envelopes, you won't have to rush when you file your tax return.

In addition, if it is difficult to understand the purpose of use just by looking at the receipt, make a note of it in an empty space on the receipt. If you erase it with , it will be smooth when sorting by expense later.

When paying for expenses, there are cases where you pay not only in cash, but also by credit card, or withdraw from your bank account, such as rent and utility bills. If you use the same card or account as your personal payment for these payments, the sorting process will be difficult, so prepare a dedicated one for your side business.

When calculating and recording rent, utility costs, etc. on a proportional basis for housework, keep the data and calculation formulas that serve as the basis for that. In some cases, you may be asked questions during a tax audit, so don't panic.

You are obliged to keep the documents you filed for the final tax return for a certain period of time as follows.

White Declaration: 5 years from the closing date

Blue Declaration: 7 years from the closing date

This time, I explained tax returns and expenses for beginners who started importing from China as a side business.

Product sales involve various expenses, so I hope you understand that keeping track of the details will lead to tax savings when filing your tax return.

Filing tax returns is a very troublesome task, so it is a good idea to get into the habit of regularly organizing documents and keeping receipts from your side jobs.

Once your business is on track, we recommend that you consider actively using an import agent. Our THE direct flight is an import agency professional affiliated with Alibaba, and can be useful not only for purchasing but also for providing data in terms of cost management, so if you are interested, , contact us anytime.

Until the end Thank you for reading!

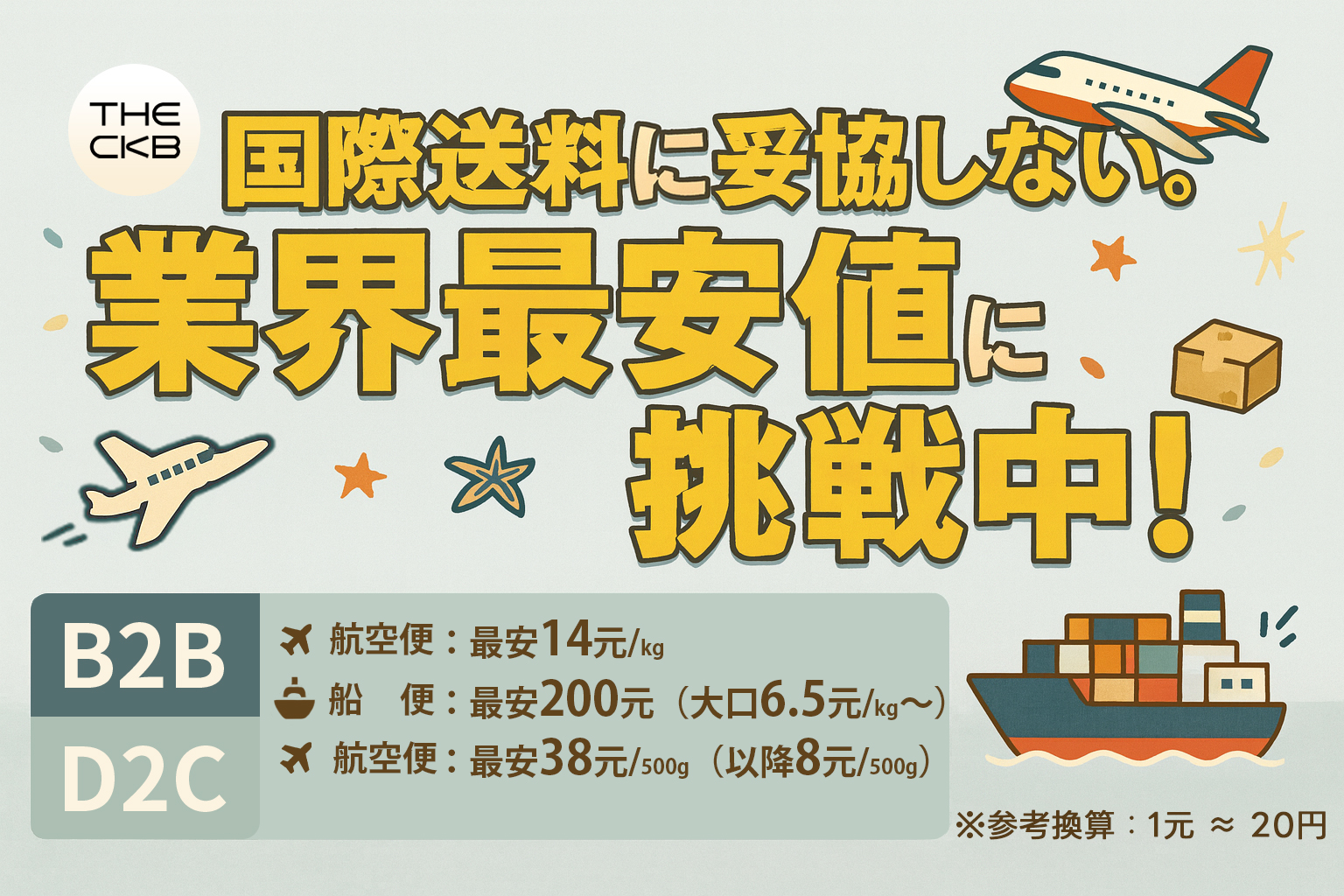

\ 他社より高ければ、ぜひ教えてください! /

小口直送も大口発送も、国際送料は業界最安水準。

航空便最安 38元(約700円)~

船便最安200元(約40,000円)~

無料登録ですぐに送料をシミュレーション。

自社商品のコストを事前に把握できるから、初めての海外仕入れでも安心です。

▶ 詳しくはこちら > https://www.theckb.com/price/shipping-fee/

Please feel free to contact us.

080-6583-7346

Reception hours: Weekdays:10:00~17:00

Try to consult online

Reception hours: Weekdays:10:00~18:00

For any questions or concerns regarding THE CKB service, please contact us here.

Thank you, we have exceeded 35,000 system users! Smooth process from product selection to ordering and shipping!